Hard-working, creative and valued employees are the most powerful assets available to any business. That’s why it makes sense to protect against the loss of certain key members of staff, bolstering your company against the financial and operational fall-out of such an event. There are a range of life insurance plans which cover key employees, shareholders, directors and partners where required.

Hard-working, creative and valued employees are the most powerful assets available to any business. That’s why it makes sense to protect against the loss of certain key members of staff, bolstering your company against the financial and operational fall-out of such an event. There are a range of life insurance plans which cover key employees, shareholders, directors and partners where required.

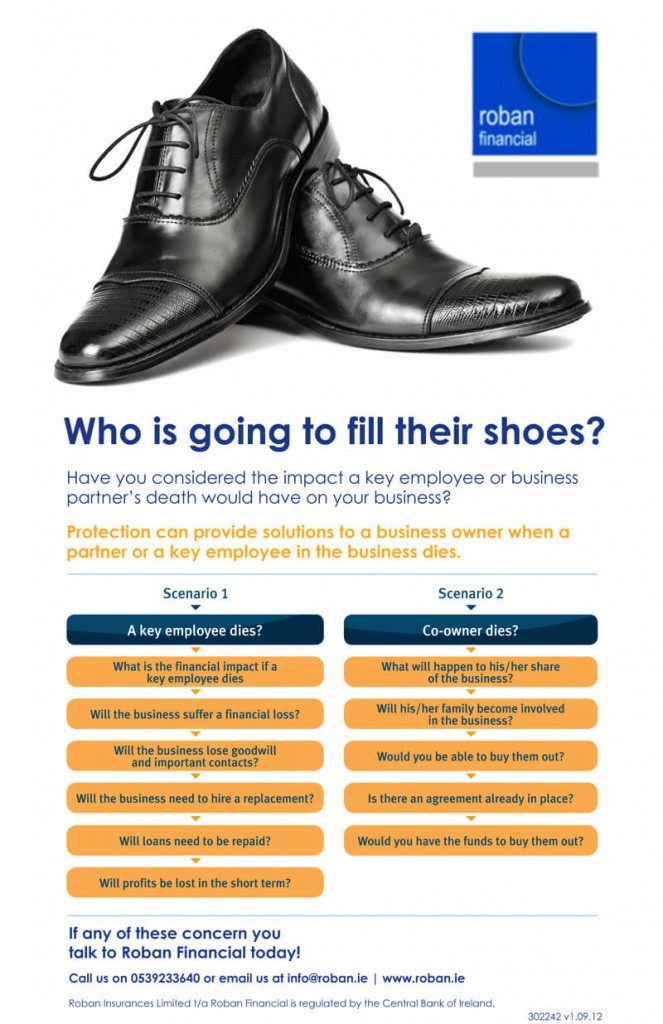

The directors of a company are often the major shareholders and key decision-makers within a firm. A successful business depends on the co-operation and experience of its directors. If one of these directors becomes seriously ill or dies it can create great difficulty for surviving directors and the deceased’s successor(s) alike. Thus the need to have a Co Directors Insurance in place which will give the company the security that there will be funds available to buy back shares should this happen

Can you add a graphic with Business Protection in the Centre (similar to the financial planning one) & the following around it as such:

Key Person Insurance

Co – Director Insurance

Partnership Insurance

Group Risk Cover

And underneath can you put boxes similar to the Financial Life Planning Page with the definition of each of the above in the boxes as follows:

Key Person Insurance

Key Person cover provides protection against the loss of an extremely valued employee of high financial or strategic importance to a business.

Co – Director Insurance

Co-director Insurance can bring security and stability to a company’s directors. In the event of the death of one of the directors, it will allow the surviving directors to buy the deceased’s shares from their next-of-kin if these unfortunate events occur.

Partnership Insurance

This is a specific kind of insurance policy that protects the financial security of a business partnership by compensating a deceased partner’s estate for their share of the partnership

Group Risk Cover

Group risk cover allows companies to offer employees special benefits that will compensate their families in the event of death or disability. Life cover can bring employees peace of mind, as they know that their families will be looked after if they die. Group disability benefits allow an employer to pay a portion of an employees salary if they are affected by illness or injury for a prolonged period of time