Financial Life Planning

Financial Life Planning

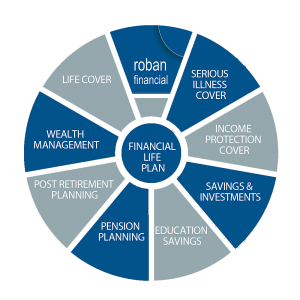

Roban Financial specialise in financial life planning.

We always view our services in terms of our clients’ needs, and we will continuously work with you to help you build the kind of future you desire. We do this in the spirit of family values, life enjoyment and peace of mind for the future.

Our goal is for you to achieve your financial objectives, our role is to guide you there.

Our clients value our services and each and every client requires a different service, dependant on the stage of their lives they find themselves at.

The Financial Life Plan can cover some or all of the below at any one stage;