How to Save on Gift & Inheritance Tax

Here’s a comprehensive guide on how you can leverage these plans to save on gift and inheritance tax.

Here’s a comprehensive guide on how you can leverage these plans to save on gift and inheritance tax.

If your company has surplus cash, have you considered how effectively it’s working for you?

If your company has surplus cash, have you considered how effectively it’s working for you?

Navigating retirement planning in Ireland involves understanding both private and state pensions. Here’s a breakdown of key questions to consider:

Navigating retirement planning in Ireland involves understanding both private and state pensions. Here’s a breakdown of key questions to consider:

This comparative analysis underscores the need for employers to carefully consider the integration of AE with their current pension provisions

Mortgage protection is designed to clear your mortgage in the event of your death. Life insurance, on the other hand, is a broader concept that typically means a lump sum payment to your family in the event of your death.

Opting to leave your pension untouched might seem convenient, but it’s often not advisable. This is primarily because pension schemes are not compelled to maintain communication with you or provide annual updates on your pension’s management or investments. Consequently, you lose insight and control over investment decisions.

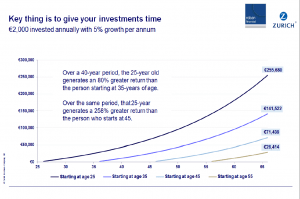

Starting early is the best thing you

can do for your pension. Over 40 years, someone who starts saving at age 25 will see them have over €123,000 more

in their pension fund than someone who starts at age 35.

Without a Will, the default Intestacy Laws come into effect, potentially contradicting the true wishes or intentions of the deceased.

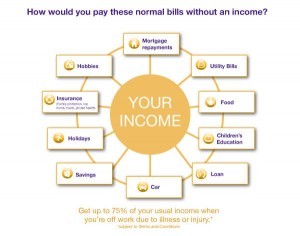

Income Protection plays a pivotal role in maintaining financial stability during unforeseen health setbacks.

Whether it’s saving for a new home, planning a dream wedding, preparing for college fees, or building a safety net against unforeseen events, having a robust savings plan is crucial.

While we can’t assist with getting healthier or fitter, we can definitely guide you in saving money and enhancing your financial resilience in 2024

Individuals aged between 23 and 60 and earning over €20,000 annually will be automatically enrolled into the pension scheme on starting a new job,

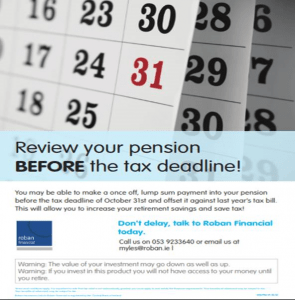

If you’re in a position to enhance your pension contributions, doing so before the tax deadline can provide tax relief against your 2022 income

Explore the impact of Budget 2024 and how it may affect your financial planning.

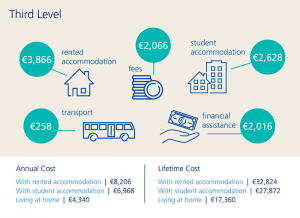

The annual ‘Cost of Education’ survey reveals that more families are now inclined to initiate a savings fund compared to the previous year. Key Findings: A Shift Towards Savings: The number of families planning for future savings has surged

Empowering individuals to take control of their finances is essential. However, managing investments on your own might not always be the best approach. While it might seem like a straightforward task, akin to assembling a piece of furniture, the intricacies

Income protection insurance offers a safety net by providing a regular cash payment if you’re unable to work due to a prolonged illness, injury, or disability. This is different from private health insurance and doesn’t cover redundancy. What

Unlocking the Power of Compound Interest: The Regular Savings Plan Albert Einstein, one of the most brilliant minds in history, once remarked, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who

Navigating the complexities of inheritance tax can be daunting. In Ireland, it’s essential to understand the ins and outs of inheritance tax planning to ensure that your loved ones receive the maximum value of your estate without being burdened by

In Ireland today, more couples are opting for cohabitation, either delaying marriage or forgoing it altogether. The Law Society’s 2016 census revealed that out of 1.22 million families in Ireland, over 152,000 are cohabiting. This represents a 6% increase since

When it comes to our finances, most of us tend to go on hunches or on the advice of a close friend or relative (albeit despite their best intentions, not being qualified). However, navigating the intricate maze of personal finance

We were delighted to host a Breakfast Seminar in the Riverside Park Hotel on Tuesday last 28th March in conjunction with Irish Life. Kevin Fitzsimons, Pensions Development Manager, Irish Life presented very informative and interesting presentation on the topical subject

Minister for Finance, Paschal Donohoe T.D., and Minister for Public Expenditure and Reform, Michael McGrath T.D., delivered the details of Budget 2023., yesterday 27th September. Jim Power, Economist summarised it by stating; “Budget 2023 can accurately be described as a very

The Minister for Finance and Minister for Public Expenditure and Reform have announced details of Budget 2022. The budgetary preparation process is far more transparent than it has been in the past, and therefore there were no real surprises announced

We would like to wish you a Happy and Peaceful Easter. Our office will close on Thursday evening 1st April and we will return Tuesday April 6th.

The importance of inheritance tax planning is not in question. However it may not be well known that there are measures you can take to alleviate at least some of the burden of same. The standard Gift and Inheritance tax

All of us at Roban Financial would like to wish you a very Happy Christmas and Peaceful New Year. Thank you for your continued support during 2020 and we look forward to meeting you again in 2021! Our offices are

We hope you are all keeping well through these uncertain times. We appreciate that while we have had to adapt the way we live our lives due to the ongoing threat of Covid 19, that our financial needs remain the

Our Government has just commenced phased re-opening of the country, as of yesterday 18th May 2020. In adhering to Government guidelines and in the interest of public safety, to both our clients and staff alike, we would like to assure

In adhering to Government guidelines and in the interest of public safety, to both our clients and staff alike, we would like to assure you that we are taking every measure to manage and minimise the risk of COVID-19 and

We are in unprecedented times in our world, facing a global pandemic due to Coranavirus or Covid 19. It is truly an anxious time and we all need to do what is required of us now to stay safe. With

After a lengthy and very strong investment run, the investment markets are under a lot of scrutiny currently due to the effect of the Coronavirus. This of course is not welcome news, either in the investment industry or for any

Several weeks into the New Year, the media coverage and social media is yet again very focused on all our New Year Resolutions from keep fit regimes, menu planning, house decluttering and financial planning. All of which are very positive.

All of us at Roban Financial would like to wish you a very Happy Christmas and Peaceful New Year. Thank you for your continued support during 2019 and we look forward to meeting you again in 2020! From All at

Multi‑Claim Protection Cover is a new plan introduced by Royal London who advised that it is “a severity‑based policy aligned to the progression of modern medicine and health”. So what does this mean? In short, this means that claims are paid in line with the severity of the impact that the condition or illness may have on your life. Each claim also has the potential for multiple payout components.

It’s that time of year again when parents very much feel the financial strain of the return to school and college. And whilst September is traditionally associated with hugh expense, it is a timely reminder that to save all year

Roban Financial are delighted to welcome Laura O’Donnell, Qualified Financial Advisor to our expanding team. Laura is a Qualified Financial Advisor with a wealth of financial services experience, particularly in the banking sector, having worked with Bank Of

Most of us will have heard of Marie Kondo this year and her de-cluttering methods which are based on the ability of all your belongings to spark (or not as the case may be!) joy. Only when they spark joy

A defined contribution pension scheme (DC) is an employer sponsored pension scheme, where Employers make pension contributions to a pension for employees who also contribute to the pension plan. Such a scheme aims to give you sufficient income to live

During our recent Auto Enrolment Seminar, Michelle Leacy of Zurich gave a short presentation on Investing. One particular slide resonated with our audience that day as it clearly demonstrated the importance of starting to contribute to pension from an early

Thank you to all those who attended our hughly successful Auto Enrolment Breakfast Briefing today held in conjunction with Enniscorthy Chamber and Zurich Life. A special note of thanks must go to Jimmy Gahan and Marie Lyng and all support

As per our recent blog post, there are plans to introduce auto enrolment to pensions for employees in Ireland. The mandatory pension scheme is being introduced to address the issue of a high level of workers who have no pension plan

As per our recent blog post, there are plans to introduce auto enrolment to pensions for employees in Ireland. The mandatory pension scheme is being introduced to address the issue of a high level of workers who have no pension plan

It is estimated that there is over €90 billion held on deposit in Ireland, in a time where deposit rates are historically low. This is likely driven by the fear of losing money especially given the losses incurred during the

As you may have heard there are plans to introduce auto enrolment to pensions for employees in Ireland. So what does this mean? Essentially once it is fully implemented it means that employees will have up to 6 per cent

Pension planning is one of those issues that can be left on the to do list! And often when we as Advisers recommend Pensions, there are genuine concerns in relation to the tax efficiency of pension savings. Tax relief on

Several weeks into the New Year, the media coverage and social media is awash with 2 main themes as far as I can see; decluttering Marie Kondo style and organising your life including your financial life with to do list’s

We wish you all a very Happy New Year and all the best for 2019. We look forward to seeing you throughout the year.

All of us at Roban Financial would like to wish you a very Happy Christmas and a Peaceful New Year. We look forward to seeing you all in 2019.

We cannot have missed the fact that not only was last Friday Black Friday but it was Black Friday Week. And it continues with today being Cyber Monday. There has actually been a lot of discussion in the media about

View our full Budget Summary; Budget Summary 2019

I have blogged about Business Protection before but think it is worth recapping on as it is a vitally important part of what we as Financial Advisors can do to assist Business owners. As Business owners, the fear is that if

Our beautiful, warm summer has quickly come to a close and the routine of September is upon us already! I think it is fair to say most of it are embracing it rather reluctantly! Of course with September comes the

Zurich Life have just released their latest Cost of Education in Ireland study. While it feels like we have just settled into the summer holidays, many will have already started to plan for the return to school and college in September.

It is a harsh reality that all too many people are diagnosed with a serious illness in their lifetime. The good news is that a lot of serious illnesses are treatable to the extent that a full recovery can be made.

As you may be aware the General Data Protection Regulation (GDPR) (Regulation (EU) 2016/679) came into effect on 25th May 2018. So what impact does this have on your relationship with Roban Financial? As a Financial Services provider, Roban Financial always

Tax relief on pensions is often a contentious issue. One of the main arguments against actually contributing to pensions in order to fund a retirement pot as such is the perception that whilst tax relief if available on entry, effectively

Roban Financial together with Frizelle O’Leary and Doyle Fielding Accountants held a very informative Succession Planning Tax Seminar in the Riverside Hotel, Enniscorthy Tuesday night 10th April last. John O’Leary of Frizelle O’Leary focused on succession planning from a legal

Thank you to all those who attended what was a very informative Succession Planning Tax Seminar last night in the Riverside Park Hotel, Enniscorthy. The seminar drew a large attendance and feedback has been very positive. Succession Planning was the

Wishing you all a very Happy St. Patrick’s Day & weekend. Our offices will be closed Monday 19th March and we will re-open at 9 am on Tuesday 20th March. Thank you

We have received a lot of queries about the financial review process recently and indeed the cost of the service. I’ve blogged about the steps in the process before but thought it no harm to recap below. In relation to

Due to the recent adverse weather conditions and continuing challenging travelling conditions, Roban Financial together with Doyle Fielding Chartered Accountants and Frizelle O’Leary, Solicitors have decided to postpone our Seminar on Wednesday next 7th March. We will hold the Seminar

Whilst we strive to empower people to provide life and serious illness assurance cover for themselves in order to protect their loved ones, we like our clients, hate to actually really think about it. None of us wants to leave

Due to the adverse weather conditions and for the safety of our employees, Roban Financial will close today Thursday, 1st March at 1 pm and remain closed tomorrow, Friday 2nd March. We hope you all stay safe over the coming

Success Planning Tax Seminar 2018 Date: Wednesday 7th March 2018 Time: 7.30pm Venue:Riverside Park Hotel, Enniscorthy, Co.Wexford MC: PJ Fielding Speakers: Jim Power, Myles Roban, John Burke O’Leary, Eugene Doyle This is a FREE EVENT, all welcome to attend.

As the saying goes “Fail to Plan, plan to Fail”. This is a very true saying in all aspects of our lives but none more so than in our financial planning lives across all areas of financial planning. We all

Several weeks into the New Year, how are your New Year Resolutions going? The New Year is certainly a dream for the commercial world in terms of the products and goods we see in all the supermarkets and shops this

All of us at Roban Financial would like to wish you all a very Happy Christmas & Peaceful New Year. We would like to sincerely thank you for all your support during the year and we look forward to meeting

Proper financial planning is extremely important. It can mean the difference between being able to enjoy life knowing you are planning and preparing for the future and simply not being prepared for life’s important events. For that reason it is important to

Due to continued expansion, we are delighted to announce that we are moving to a larger office in the same building here in Slaney Place, Enniscorthy. We are closing tomorrow, 24th November to facilitate this move. We will have limited

The last couple of weeks likely saw a lot of you meeting with your Accountant to get the not so good news of tax due. Of course a higher tax bill actually means ultimately higher profits for the previous which

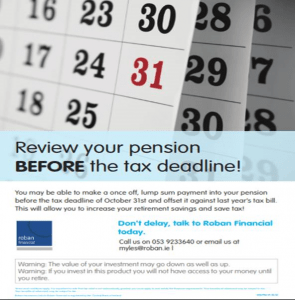

As we fast approach the October 31st year end (or November 14th if you file your return online) it is timely to remind you of the hugh tax savings that can be made by contributing to your pension at this time

Please be advised that the offices of Roban Financial are now closed this afternoon to ensure the safety of all our staff. We would remind everyone to stay safe as we all look forward to Storm Ophelia passing.

As you may be aware the General Data Protection Regulation (GDPR) (Regulation (EU) 2016/679) will place requirements on all businesses and organisations to implement strict Data Protection policies and procedures by 25th May 2018. Whether as a business or voluntary organisation,

October 10th saw the Finance Minister Paschal Donohue unveil the most recent budget. So how will it affect you? Here’s a brief overview of some of the changes that will likely affect most Irish households. Income Tax; An increase of

The October 31st Tax Deadline (or Tuesday 14th November 2017 if you file and pay online) is fast approaching and no doubt Accountants & Clients alike are looking forward to the conclusion of all the paperwork that goes with same, not to

We are living in a new increasingly liberal society, one which generations before us could scarcely have imagined. Ireland, once an extremely traditional country now allows divorce and same sex marriage! It is now common place to live together before

It might seem like a strange question but we need to become more aware of the need to insure ourselves like we insure our cars and our houses. If we think of it, we are our own money making machine;

Congratulations to all those starting their third level courses today! No doubt those places were hard earned, with increased point requirements and level of competition for places in third level, it will have been a stressful year for many. Hopefully

Aviva have just announced the results of research carried out with Irish SME’s , in May of this year, in relation to Business Protection*. They found that: Two out of three Irish SMEs claim to rely on a single individual

According to Media reports this week, there is a Government proposal to extend the current pension age to 70. Whilst the Government have rejected this proposal, at least for now, we have to consider the real possibility of it happening

For many families, today is the first day of the Summer holidays! And much like we were, our children are no doubt excited about Summer and enjoying the feeling of having a nice long, (hopefully sunny!) summer in front of

Most of us will remember our first introduction to investing. Personally I recall setting up an SSIA and at the time, my knowledge was pretty much limited to investing in the ‘risky’ one or the ‘safe’ one. My friends &

The Irish Association of Pension Funds (IAPF) recently commissioned a survey to examine retirement planning in Ireland and gauge people’s opinions and expectations of their retirement. The survey concluded that many people simply avoid thinking about retirement for much of

Are you co-habiting? You should be aware of the Inheritance tax implications for unmarried couples. Did you know that as a co-habiting couple, there are potentially major tax implications to you on the death of your partner, if you receive

We cycled a stretch of the Waterford Greenway yesterday (from Dungarvan to Durrow to be exact) and thoroughly enjoyed it. It was nicely busy and so nice to see so many people, walking, running and cycling it, in particular lots of

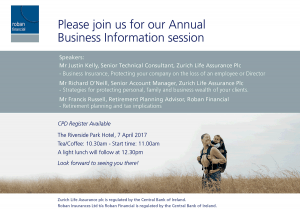

During our recent Annual Business Information Seminar, Justin Kelly and Richard O’Neill of Zurich Life gave excellent presentations highlighting the importance of good Business Protection planning and Succession Planning. Francis Russell of our office concluded the Seminar with an interesting presentation

As readers from previous posts will know, the second part of our Annual Business Information Seminar focused on Strategies for protecting personal, family and business wealth. Richie O’Neill from Zurich Life presented an excellent, very humorous (especially considering the topic!)

As you may be aware from previous posts, we recently held another very successful Business Information Seminar which was strongly attended by Accountants, Solicitors and clients alike. I plan to summarise each presentation over the next few weeks and will

We would like to take this opportunity to wish all our loyal customers a very Happy Easter. Our offices will be closed tomorrow Good Friday, 14th April for the Bank Holiday weekend. We will reopen at 9 am Tuesday 18th

Last Friday we once again held our Annual Business Information Seminar and we are delighted with the positive feedback we have received. Whilst the topics by their nature can be at times technical, we had 3 excellent presenters who had

We are looking forward to our Annual Business Information session which we are holding in the Riverside Hotel, Friday 7th April next. We are holding this year’s session in conjunction with Zurich Life with a view to focusing on specialist

As you know we recently welcomed Elaine Finn to our team, thus enhancing our staff numbers with relevant qualifications with the aim of enhancing our service to you, our clients. We have also recently enhanced our website. We hope you

You may well have heard the recent radio campaign advising Employers that if you do not find the time to put a pension scheme in place for your Employees that you are breaking the law. The Ad in itself is

These were the words of a friend of a friend to me recently, when she discovered I worked in financial services and told me her story of severe financial loss (of pension funds invested) during the recession. My heart went

I think it is fair to say that in general, there is a far greater awareness of what a Bank can offer than what a Financial Broker can offer. We are all familiar with the main Irish banks, probably due

I personally have many a “to do list” which itemises the multitude of tasks I need to deal with on a daily basis. It is a simple and satisfying way of ticking off those tasks be it the shopping list

Roban Financial are delighted to welcome Elaine Finn to our team. Elaine has over 10 years experience in the Banking and Financial Services sector. Elaine’s role will be to further enhance the dedicated personal review service we offer to our

Are you co-habiting? If so, you need to be aware of the Inheritance tax implications for unmarried couples in relation to the property and/or life assurance policy either or both of you hold. If as an co-habiting couple, you have

Over half a million families in Ireland do not have life cover (as per Irish Life). We provide many services to our clients, one of the most important of which is highlighting the need for life cover to people in

In this part of the Country at least (Wexford) it is a wet, miserable day and the fleeting thought of the luxury of retirement might have passed your mind this morning! Retirement can be luxurious in terms of being able

Running a business can take up all our time and and energy and can leave little time to think about anything else! A business grown from small beginnings to a successful enterprise can be a source of great satisfaction and

Last week, I spoke about the importance of personal cover, be it life cover, serious illness cover or income protection cover. Having such plans in place can alleviate the stress of what would be a very tough time in any

A New Year symobolises a new beginning and traditionally brings with it a multitude of New Years Resolutions. For the most part I believe, New Year Resolutions are well intentioned and are of benefit, even if they do not last the

Thank you for your patience – our phone issue has been resolved and the phone lines are fully operational again. We look forward to hearing from you! Thank you Roban Financial.

We do apologise for the ongoing phone issues we are experiencing. If you need to contact us please contact Myles at 086 2555127 or the office by email at info@roban.ie. Thank you. Roban Financial.

Please bear with us as our phone systems are down today, Wednesday 4th January. We hope to have this issue resolved as quickly as possible but in the meantime please contact us at 086 2555127. Thank you Roban Financial

We would like to wish all our loyal clients a very Happy New Year and we hope the year ahead brings health, happiness and good fortune to you all. We have a Staff Training today tomorrow, Tuesday 3rd January and

We would like to wish all our loyal customers a very Happy Christmas and a Peaceful New Year. May 2017 bring health and happiness. Thank for your continued support and we look forward to seeing you again in 2017. We

As the year draws to a close, it is a good opportunity to think about the year ahead and while we might not always stick to our New Year Resolutions, it can be worth making and sticking to at least

With the year hurtling to an end (where did the year go?), we might be thinking of a clean slate in January for lots of reasons! If one of your New Year’s Resolutions is to save more during the year

With its origins in the US, ‘Black Friday’ has fast become a major event here in Ireland too with all major retailers offering not only ‘Black Friday’ specials but weekly specials and beyond! It is human nature to love a

If you file and pay online you still have a few days to make a contribution to your pension and reduce your tax bill (as 10th November is the deadline). So how can this be done? Self Employed & Proprietary

As any of you with young children will know, Children’s Allowance is paid monthly and the amount varies depending on the amount of children one has. It will not make any of us rich but it is welcome, and for

It is fair to say we are in a time when financial brokers are transitioning from offering a ‘free’ service to seeking payment from clients for their services. This is due to many factors, including the changing commission market (whereby

The October 31st Tax Deadline (or 10th November 2016 if you file and pay online) is fast approaching and no doubt Accountants & Clients alike are looking forward to the conclusion of all the paperwork that goes with same, not

Most of us probably listened to countless interviews yesterday with Michael Noonan in particular, regarding Budget 2017. It has been dubbed the “Fiver Budget” due to the fact that it gives a little to everyone. Many feel this is not

Budget 2017 is well underway & this is what we know so far; 9% VAT rate for tourism and hospitality industry will be retained Start Your Own Business scheme to be extended for a further two years Low cost, highly flexible loan fund

You may well have heard the recent radio campaign advising Employers that if you do not find the time to put a pension scheme in place for your Employees that you are breaking the law. The Ad in itself is

Thus started a very interesting article by Charlie Weston in the Irish Independent earlier this week. A heading that caught my eye as it’s an often quoted phrase ie. “A young persons game” but not often used in terms of

Most of us, as parents, would love if one parent could stay at home full time with our children. The value of a stay at home parent, it can be argued, is truly priceless in terms of the emotional welfare

Capital Acquisitions Tax/Gift Tax legislation allows for an exemption for the first €3,000 of any gift taken by a beneficiary from any one donor. This is an annual exemption, which means that a beneficiary can receive up to €3,000 tax

A friend recently told me that she was starting to consider saving into a pension and that she had not considered it until then as her earnings only qualified for 20% tax relief. While her salary was not substantial, it

Whole of Life plans are protection plans that promise to pay out an agreed life sum assured on death ie. they are valid for the whole of your life. Whole of life protection plans have declined in popularity due to

The count down to back to school begins, and likely, depending on the age of your children, they are are loving or hating the idea of going back to school! It an expensive time for parents with not only the

I realise the title sounds like the title of a good thriller (Google has confirmed to me that it is not, though it does seem to be popular in song lyrics!). However for the purpose of this blog, I want

Are you organized in your financial life? If so, well done – I would hazard a guess you are one of the few who are! I think it would be fair to say that the majority of us, for many,

I re-tweeted the start of an Article published in the Irish Times last week by David Begg who quoted the great American playwright Tennessee Williams who once said “You can be young without money but you can’t be old without

Happily, having been lucky to enough to have a lovely sunny Sunday, we had a barbeque and during the course of the afternoon, somehow the conversation turned to the cost of sending a child to third level education. Due purely

Much has been written in recent weeks about the impact on Ireland of the decision by the UK to leave the European Union. I think it is fair to say that for the most part, it came as a shock

Most of us don’t like to contemplate what would happen if are unable to work due to illness or accident. When we do force ourselves to think about it, the overriding fear naturally, is the effect of the illness or

I heard an advert recently which promoted the Financial Broker. And the thought occurred to me that many would assume that a financial broker can really only be beneficial to them if they are financially wealthy or at the very

You might have heard the radio advert this morning for the European lottery; it posed a series of thoughts which were by definition looking at things from different perspectives; for example in one, the speaker was thinking that was a

If you have, you’re likely kicking yourself, you did not invest before now, as time fly’s past and you realise if you’d invested it say a year ago, you would have one year of potential positive returns behind you instead

The Wexford Business Awards take place tonight, 27th May in Clayton Whites Hotel, Wexford. We are delighted to have been shortlisted in the Operational Excellence Category and wish the very best of luck to all our fellow nominees, Kerlogue Nursing

As mentioned in our previous blog, the Seminar we held on Wednesday last was very well received. Our presenters Pat Ryan, Davy and Gerard Keane of Newcourt presented their respective presentations of what can be a very technical topic namely

Thank you to everyone who attended our hughly successful Seminar this morning. Thank you to Pat Ryan, Davy Select, Gerard Keane, Newcourt and Jim Power, Jim Power Economics, all of whom gave extremely interesting presentations. Pat spoke about the Pensions

We are looking forward to our Seminar which we are hosting in the Riverside Park Hotel, Enniscorthy this morning and delighted to have a great line up of Guest Presenters; Gerard Keane Newcourt Retirement Fund Managers “Self Invested Pension Structures

Capital Acquisitions Tax/Gift Tax legislation allows for an exemption for the first €3,000 of any gift taken by a beneficiary from any one donor. This is an annual exemption, which means that a beneficiary can receive up to €3,000 tax

No doubt if you are running your own business, it requires all your energy, time and focus. In fact a work life balance is an entirely different blog for another day! However the danger with focusing on the business ‘today’

This was the title of an Article published in the Irish Independent on Thursday 28th April last. It was an informative article on the Financial Broker market with some interesting points in relation to highlighting the different types of advisors

As you may know, Roban Financial are honored to be nominated in the Operational Excellence Award category in this year’s Wexford Business Awards. This Award recognises the Lifestyle Planning Service Roban Financial offers clients. So what is a Financial Life

Roban Financial are delighted to be shortlisted for the Wexford Business Award recognising Operational Excellence. This Award recognises operational excellence within the nominated businesses and Roban Financial are delighted that our Lifestyle Financial Planning Service has been recognised for its

Many of us are of course making pension contributions to some degree with the aim of achieving a comfortable retirement, an issue I have previously discussed on this blog. However when we actually look at the tax relief available on

Did you know that as an Employer (even if you are a small business owner with no more than one employee) you have a legal obligation to make a PRSA available to your employee/(s)? So what is a PRSA? A

The Dublin Institute of Technology prepare a Guide every year for students to inform them of the cost of their third level education. The report last July (2015) highlighted the fact that due to the cost of increasing college fees,

You may have seen/heard the Advertising Campaign Friends First have just launched for their Income Protection Product. I most definitely welcome such a campaign which raises awareness of the need for Income Protection and in truth, makes us think about

Wishing you all a very Happy Easter. Our offices will remain open on Good Friday, March 25th next. We will reopen after the Bank Holiday on Tuesday 29th March.

Although most of us don’t wait that long to start one, many of us will retire on a measly pension because we have started to pay into it too late – and the contributions we are paying are too low.

Are you co-habiting? You should be aware of the Inheritance tax implications for unmarried couples. Did you know that as a co-habiting couple, there are potentially major tax implications to you on the death of your partner, if you receive

I read a very interesting blog recently by Eoin O’Gorman (referenced with Eoin’s permission; please see www.ogormansolicitors.ie) , a Wexford based Solicitor who wrote about a question he often gets asked namely whether the selection of Godparents for their children

Life cover in many cases should, in my opinion, be as high on our list of priorities as house or car insurance. Why? If we think about it we all acknowledge that our home is hughly important as is our

Myles & Francis of this office attended a very informative Seminar “Pensions & Investments Seminar” held recently by Davy Select. The findings of the recent Irish Association of Pension Funds – Benefits Conference were discussed. Of particular note were the following

On a Monday morning most of the working population can fairly accurately predict what the rest of the week will bring. With the week more or less mapped out in advance, you can get on and apply yourself to the

I have given €20,000 to each of my children as part of their inheritance. Do they or I have to notify the Revenue or will they be asked when I pass on? I know the limit is €225,000 for each

CANCER is the main reason for claims made for life insurance and serious illness cover, a break-down of payouts made by Irish Life shows. The life company said it paid out €168m in life insurance and specified illness claims last

Unmarried co-habiting couples are frequently unaware of inheritance tax implications on claims over life cover policies and the legitimate means of managing those – according to Caledonian Life. Evidence from brokers suggests that many co-habiting couples are under the false

Diversifying in stock markets is a time-honoured rule for survival and the following example makes for a simple but quite powerful message. I introduced this message into my own investment training seminars after a colleague of mine, Dermot Walsh

According to a survey of 1,000 people more than 75% of respondents were not happy with the rate of return that they were receiving on their savings, as interest rates remain at historically low levels. Many savers have come

With a series of little fees, levies and costly interest rates, banks are trying to squeeze as much out of their customers as they can. Forget about free banking. If you are an average banking customer, it’s likely that just

Less than one in 20 taxpayers claimed money back on medical expenses last year, according to figures obtained from Revenue. Income taxpayers are entitled to get back 20pc of any money spent on health expenses in a tax year.

Bank of Ireland Life paid out €94m in claims for life, illness and payment protection insurance last year, a rise of 6pc over 2011. The bank reported a rise in both the total amount paid out and the number

BROKERS have claimed that Ulster Bank has been forced to restore large numbers of homeowners to valuable tracker mortgages. One broker said he had secured a total of €300,000 in compensation from the bank over its failure to put

Many paying over the odds for mortgage protection MASSIVE differences in the cost of mortgage protection insurance have prompted calls for homeowners to review their cover, writes Charlie Weston. A couple with a home loan can save up to

€200,000,000 free Life Cover for 20,000 parents That’s €10,000 for each parent! Protecting your family’s future is one of the most important things to plan for. However, many of us don’t have any life cover at all. In fact,